The crash in oil prices is seeping into high-octane real estate markets.

Since the end of last year, energy companies have announced hefty reductions in capital spending, and major layoffs. Outplacement firm Challenger, Gray & Christmas this month said falling oil prices have been responsible for 39,621 job cuts in the first two months of the year, more than one-third of all nationwide workforce reductions in that period.That’s been rippling through the economy, with new evidence showing rental markets are taking a hit. An analysis by real estate database Zillow finds the median estimated monthly rental price for single-family homes, condominiums, cooperatives and apartments in oil-dependent metropolitan areas is rapidly slowing.

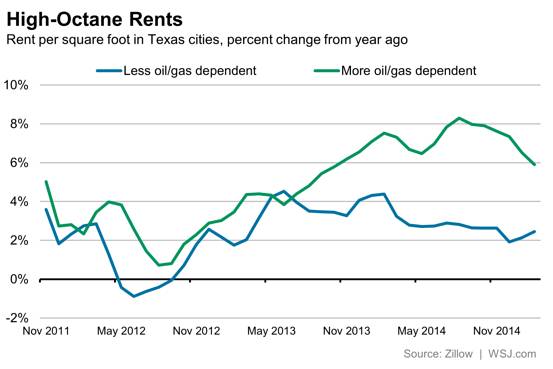

“Growth in rents per square foot in Texas’ previously booming oil-dependent markets began to rapidly cool off at the tail end of last summer, coinciding with a marked downward turn in oil prices,” said Svenja Gudell, Zillow’s director of economic research. “In August, rents per square foot were growing by about 8% per year in and around oil-dependent markets, compared to 6 percent currently.”

http://blogs.wsj.com/economics/2015/03/25/in-texas-oil-towns-price-crash-shows-up-in-slowing-rent-growth/

Read more at http://investmentwatchblog.com/the-oil-price-crash-is-rippling-through-texas-rental-markets/#mCztMA25mZ6ADLAw.99

No comments:

Post a Comment