by James Quinn

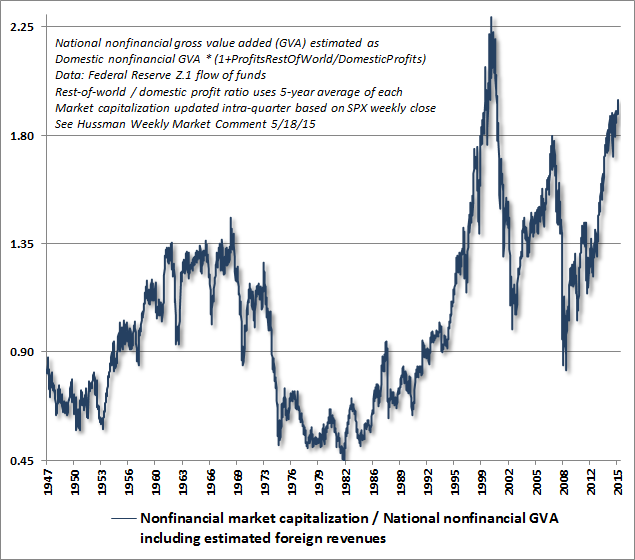

I’ve done it again. For those who don’t like to read a detailed analytical assessment of the stock market valuation, I’ve picked out the key bits from Hussman’s weekly letter. When you look back on this time in history, a decade from now, you will wonder how could they have been so foolish. History books will call this the the Era of Delusion & Idiocy. Ignore the words below at your own peril.

image: http://www.hussmanfunds.com/wmc/wmc150615a.png

When you look back on this moment in history, remember

that spectacular extremes in reliable valuation measures already told

you how the story would end.

When you look back on this moment in history, remember

that spectacular extremes in reliable valuation measures already told

you how the story would end.

When you look back on this moment in history, remember that the valuation of the median stock was never higher. Ever. Even at the 2000 peak.

When you look back on this moment in history, remember that S&P 500 returns had never materially exceeded zero over the decade following similar valuations.

When you look back on this moment in history, remember that rich valuations had not only been associated with low subsequent market returns, but also with magnified risk of deep interim price losses over shorter horizons.

When you look back on this moment in history, remember that dismal return/risk prospects were grounded in objective historical evidence, not simply opinion.

When you look back on this moment in history, remember that extreme valuations had already been joined by deterioration in market internals and credit spreads.

When you look back on this moment in history, remember that the strongest historical prerequisites for a market crash were already in place.

When you look back on this moment in history, remember that many investors ruled out the possibility of major losses over the completion of the current market cycle because they presumed relationships that could not be established in the data, and assumed the absence of any material economic or financial shock in the coming years.

When you look back on this moment in history, remember that the popular “Fed Model” was a statistical artifact, not a “fair value” relationship.

When you look back on this moment in history, remember that many investors implicitly believed that depressed interest rates and high valuations were good for future stock market returns.

When you look back on this moment in history, understand that all of this evidence was freely available.

Read Hussman’s entire Weekly Letter

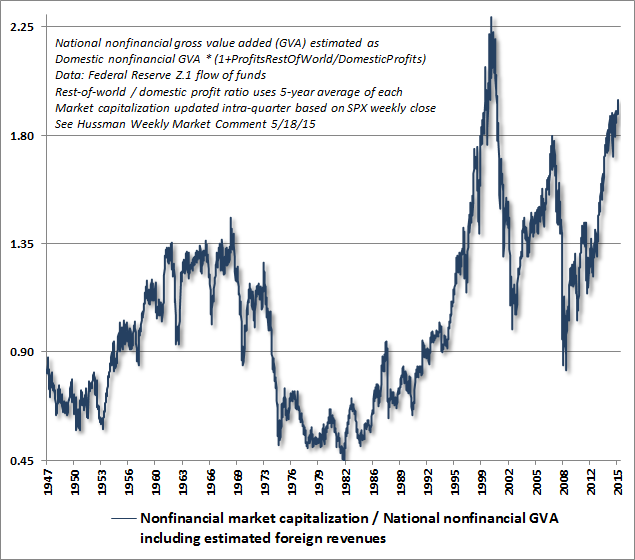

I’ve done it again. For those who don’t like to read a detailed analytical assessment of the stock market valuation, I’ve picked out the key bits from Hussman’s weekly letter. When you look back on this time in history, a decade from now, you will wonder how could they have been so foolish. History books will call this the the Era of Delusion & Idiocy. Ignore the words below at your own peril.

image: http://www.hussmanfunds.com/wmc/wmc150615a.png

When you look back on this moment in history, remember

that spectacular extremes in reliable valuation measures already told

you how the story would end.

When you look back on this moment in history, remember

that spectacular extremes in reliable valuation measures already told

you how the story would end.When you look back on this moment in history, remember that the valuation of the median stock was never higher. Ever. Even at the 2000 peak.

When you look back on this moment in history, remember that S&P 500 returns had never materially exceeded zero over the decade following similar valuations.

When you look back on this moment in history, remember that rich valuations had not only been associated with low subsequent market returns, but also with magnified risk of deep interim price losses over shorter horizons.

When you look back on this moment in history, remember that dismal return/risk prospects were grounded in objective historical evidence, not simply opinion.

When you look back on this moment in history, remember that extreme valuations had already been joined by deterioration in market internals and credit spreads.

When you look back on this moment in history, remember that the strongest historical prerequisites for a market crash were already in place.

When you look back on this moment in history, remember that many investors ruled out the possibility of major losses over the completion of the current market cycle because they presumed relationships that could not be established in the data, and assumed the absence of any material economic or financial shock in the coming years.

When you look back on this moment in history, remember that the popular “Fed Model” was a statistical artifact, not a “fair value” relationship.

When you look back on this moment in history, remember that many investors implicitly believed that depressed interest rates and high valuations were good for future stock market returns.

When you look back on this moment in history, understand that all of this evidence was freely available.

Read Hussman’s entire Weekly Letter

No comments:

Post a Comment