#Oil bears bet on $25, $20 and even $15 a Barrel in 2016. http://bloom.bg/1QVRehp

Oil speculators are buying options contracts that will only pay out if crude drops to as low as $15 a barrel next year, the latest sign some investors expect an even deeper slump in energy prices.

The bearish wagers come as OPEC’s effective scrapping of output limits, Iran’s anticipated return to the market and the resilience of production from countries such as Russia raise the prospect of a prolonged global oil glut.

“We view the oversupply as continuing well into next year,” Jeffrey Currie, head of commodities research at Goldman Sachs Group Inc., wrote in a note on Tuesday, adding there’s a risk oil prices would fall to $20 a barrel to force production shutdowns if mild weather continues to damp demand.

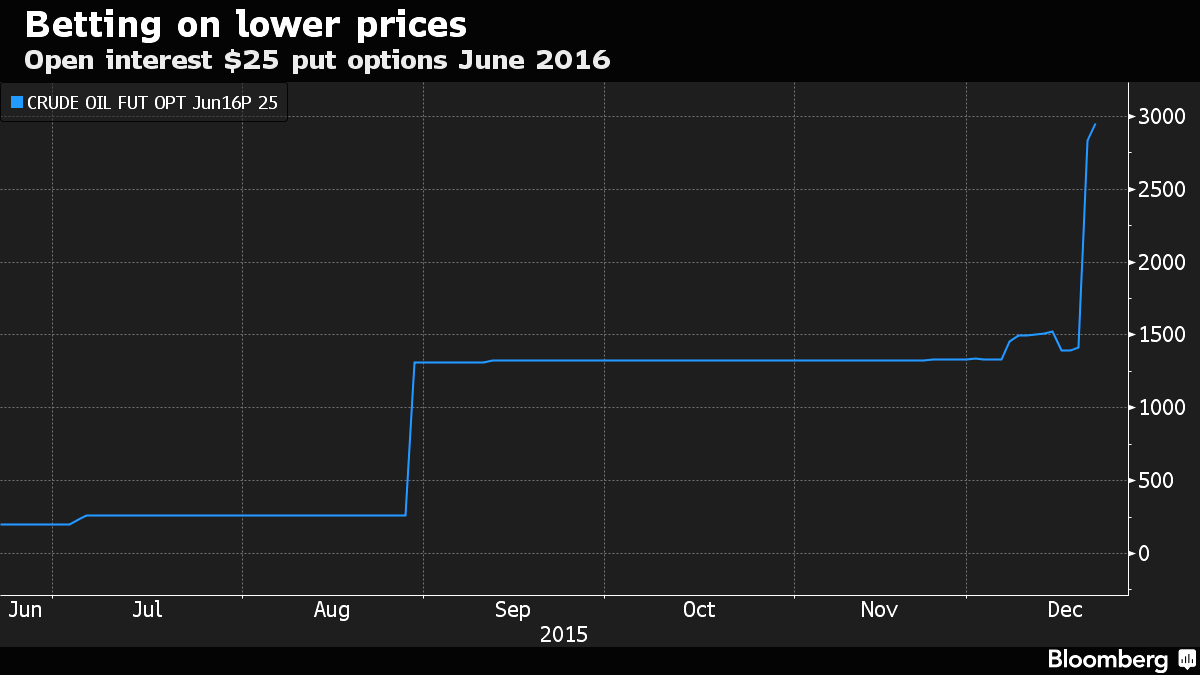

The bearish outlook has prompted investors to buy put options — which give them the right to sell at a predetermined price and time — at strike prices of $30, $25, $20 and even $15 a barrel, according to data from the New York Mercantile Exchange and the U.S. Depository Trust & Clearing Corp. West Texas Intermediate, the U.S. benchmark, is currently trading at about $36 a barrel.

The data, which only cover options deals that have been put through the U.S. exchange or cleared, is viewed as a proxy for the overall market and volumes have increased this week as oil plunged. Investors can buy options contracts in the bilateral, over-the-counter market too.

http://www.bloomberg.com/news/articles/2015-12-22/extreme-oil-bears-bet-on-25-20-and-even-15-a-barrel-in-2016

No comments:

Post a Comment