Silver Institute Reports show multi year supply demand silver deficits, as the price falls.

Physical silver supply and demand numbers don’t add up.

Late last month, the Silver Institute, in conjunction with Thomson Reuters GFMS,released its “2016 Silver Market Trends” that tracks silver supply and demand trends. Also late last month, Thomson Reuters was involved in a masssive miscalcuation of the price of silver in conjuntion the CME Group.

Miscalculation of The Price of Silver

The price of silver is determined via COMEX futures silver trading and the LBMA Silver Price. Both price discovery mechanisms involve either Thomson Reuters and the CME Group, operator of the COMEX silver futures exchange. The prices emanating from the Silver Price and COMEX have little to do with the physical supply/demand dynamics of silver, at least not in accordance with the supply and demand numbers that the Silver Institute puts together with Thomson Reuters.COMEX

The price of silver is determined on the COMEX exchange, operated by the CME Group, via the trading of silver futures and options contracts of 5,000 ounces of silver (with a physical delivery option) and mini-futures contracts of 1,000 ounces of silver (without a physical delivery option). For an explanation of how COMEX operates, click here.

The LBMA Silver Price

In August 2014, Thomson Reuters along with the CME Group, won the right to replace the “Silver Fixing Company” that was established in 1897. Thompson Reuters and the CME Group, together with the London Bullion Market Association (LBMA) launched the LBMA Silver Price, an electronic auction platform on which the price of silver is calculated.

On January 28, 2016, the Silver Price “broke” in that it produced a silver price far below the spot price of trading on the COMEX.

Such a large and glaring mismatch in the silver price between the COMEX and the LBMA Silver Price rattled the markets and shook investor confidence in the pricing mechanism of silver.

SGT bullion and David Morgan recap what happen to the LBMA Silver Price in this podcast. Ronan Manly of Bullion Star provides further details here.

Reuters reported after the Silver Price debacle that Thomson Reuters and the CME Group were working to create new silver benchmark.

Thomson Reuters’, miscalculation of the Silver Price, spurred us to revisit the silver supply/demand numbers that they compile with the Silver Institute for possible miscalculations.

Something is amiss.

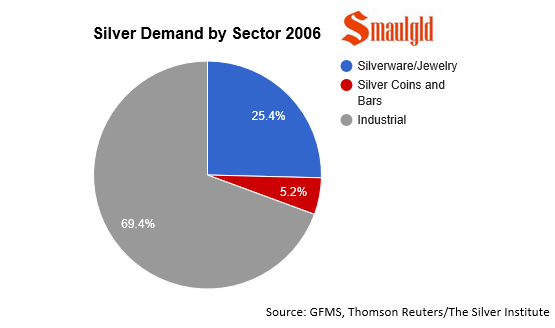

Miscalculation of Silver Demand

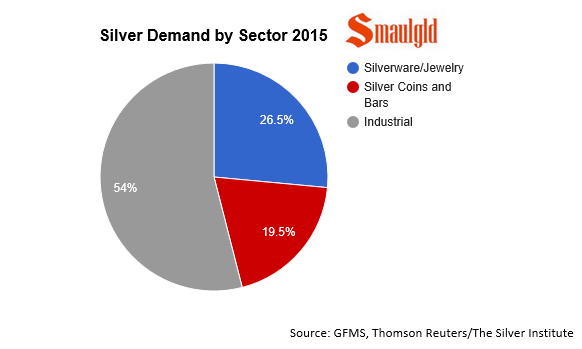

The Silver Institute includes in its demand components: jewelry and silverware, coins and bars and industrial fabrication. Determining jewerly/silverware and industrial demand can only be done by approximating demand. Silver coin demand, however, can be determined with a decent level of accuracy as each of the large sovereign mints like theAustrian, Canadian, Perth and United States Mints, publish their mintages.Silver bar demand is more difficult to estimate as the numbers of silver bars and rounds produced by private mints are less readily available. Yet, an assumption might be made that if silver coin sales are up significantly, silver bar and round sales might also be higher.

Silver Bar Demand Undercounting

In the Smaulgld 2015 Silver Supply and Demand Report, based in part on the Silver Institute’s 2015 Interim Silver Market Review, we noted the Silver Institute projected silver coin demand to rise 21% in 2015 to 129 million ounces; and overall silver coin and bar demand to rise 1.4%.In Silver Coin and Bar Demand 2015 we wrote:

We would estimate that if government mint coin demand demand is up 21% in 2015, privately minted silver rounds and bars would be up by at least that much.

The Silver Institute noted that during 2015 there was a “largely unexpected surge resulted in an unprecedented shortage of current year silver bullion coins among the world’s largest sovereign mints”.

During the great silver coin shortage of 2015, sales privately minted silver bars and rounds were also surging.

Demand for privately minted silver rounds and bars fell in 2015?

Yet, the Silver Institute 2015 projections do not include ANY increase in demand for privately minted silver bars and rounds in 2015 and reflect a stunning 21% drop!

According to the Silver Institute, silver coin demand in 2014 was approximately 107 million ounces of a total 203.5 million ounce demand for silver coins and bars. This means that in 2014, demand for silver products not produced by government mints was about 96.5 million ounces.

In 2015, the Silver Institute estimates that silver coin demand will increase to 129.9 million ounces up from 107.5 million ounces in 2015, but overall silver coin and bar demand will increase just 1.4% from 203.5 million ouces to 206.5 million ounces.

This means that, according to the Silver Institute, demand for silver bars and rounds is projected to fall 21% from 96.5 million ounces in 2014 to 76.6 million ounces in 2015.

We believe that if silver coin demand rose 21% in 2015, silver bar and round demand grew by at least the same amount.

In 2014, silver bars and rounds accounted 96.5 million ounces. A 21% increase in 2015 from 2014 would mean demand for silver bars and rounds would increase to 116.8 million ounces or a 40.2 million ounce difference from the 76.6 million ounces the Silver Institute projects.

Appendix I: Silver and Industrial Metal Revisited

If the Silver Institute underestimated 2015 privately minted silver round and bar demand, as we argue they did here, silver coin and bar demand would rise from a projected 206.5 million ounces to 246.7 million ounces and over all demand would rise from a projected 1,057.1 million ounces to 1097.3 million ounces.

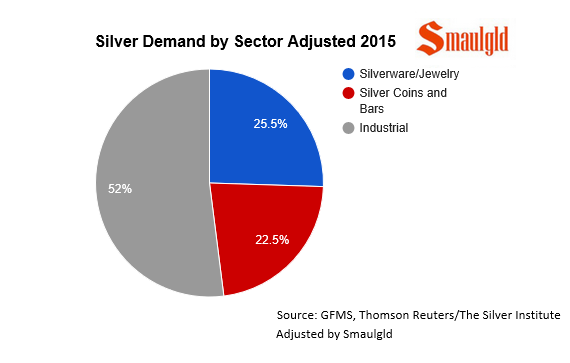

Assuming no further adjustments, this would lift the silver coin and bar demand to 22.5% and reduce industrial demand to 52%.

This chart is amended to assume that if silver coin demand grew by 21% in 2015, silver round and bar demand also grew by the same amount vs. the Silver Institute’s projection that silver round and bar demand declined by 21% in 2015.

Miscalulation of the Silver Deficit

The Silver Institute noted that physical silver was in deficit for the third year in a row.They projected a deficit for 2015 of 42.7 million ounces which was offset by “net outflows from ETF holdings and derivatives exchange inventories” to 21.3 million ounces.If however, we add the 40.2 million ounces from silver bar and round demand unaccounted for by the Silver Institute, the silver supply demand deficit rises to 82.9 million ounces or 61.5 million ounces when factoring in outflows from ETFs and exchange inventories.

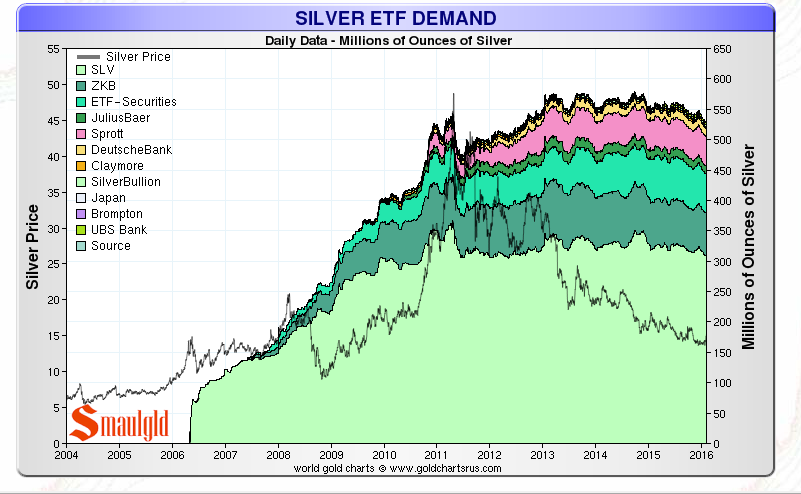

Silver Demand Calculation Does Not Include ETF Demand

The Silver Institute does NOT include demand for silver that backs exchange traded funds (ETFs) in its demand equation. They show the amount of silver demand for ETFs below their surplus/deficit calculation. When silver ETF demand is included it makes the silver defict larger.In recent years massive amounts of silver supposedly went to back silver ETFs. The Silver Institute estimates that from 2006 – 2014, 523.1 ounces of silver went to back ETFs.NONE of this silver is included in Silver Institute’s demand calculation.

Over 500 million ounces are held in silver ETFS but not included in the Silver Institute’s surplus deficit equation.

Miscalcualtion of Silver Solar Demand

According to the Silver Institute, demand for silver from the solar industry is forecast to increase to 74.2 million ounces in 2015 or about 13% of industrial silver demand and about 7% of overall silver demand.In our 2014 Silver Supply and Demand report we noted that the Silver Institute had projected 100 million ounces for use in the solar industry in 2015:

Solar manufacturers are projecting to ship a record amount of solar panels in 2014and the silver demand for the photovoltaic industry is expected to reach 100 million ounces in 2015.Last year the Silver Institute cited a 100 million ounce estimate for 2015 on their solar energy page. They have revised their solar energy page to read “close to 70 million ounces of silver are projected for use by solar energy by 2016.”

Click here to see the Silver Institute’s solar energy page as it appeared on July 9, 2014, projecting over 100 million ounces required for use in the solar energy industry in 2015.

The silver required for solar demand was slashed in the Silver Institue’s interim report at the end of 2015 to 74.2 million ounces and just two months later in their 2016 Silver Market Trends upped silver solar demand to more “than the previous peak of 75.8 Moz (million ounces) set in 2011.”Miscalculation of Supply

The Silver Institute projects that silver supply will decline 5% in 2016. This is perhaps a reasonble projection based on current silver mining output. Mining bankruptcies and production cuts, however, may cause silver output to decline greater in 2016 than the Silver Institute’s 2016 estimates.Silver In Deficit

The way the Silver Institute calculates supply and demand there will be a deficit again in 2016. The Silver Institute states that “larger deficit is expected to be driven by a contraction in supply” even though their report says that they also expect demand to rise in 2016.

The projected silver deficit in 2016, it would seem, would be driven by both decreased supply and increased demand.

The Silver Institute also projects that the 2016 deficit will be met from “drawing down from above ground stocks.” Yet the Silver Institute also notes “Scrap supply, which has been on the decline for several years, should further weaken in 2016.”

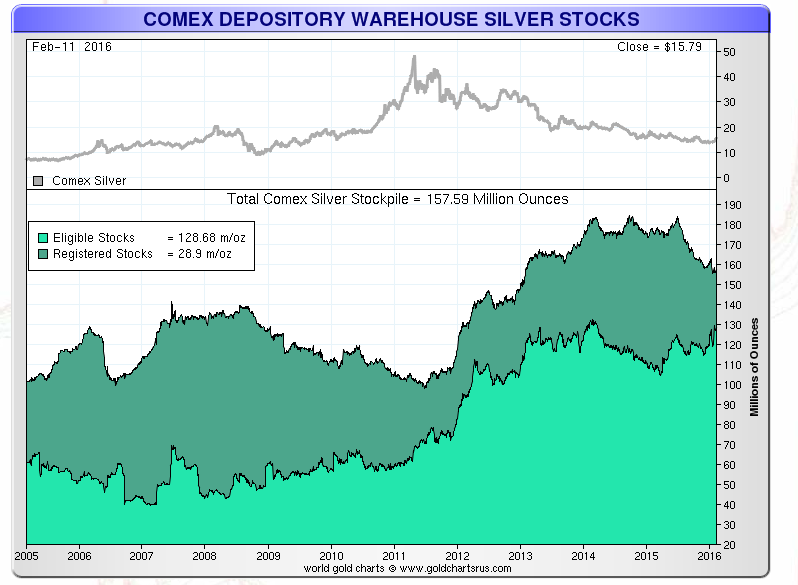

Other than scrap silver, the only other known above ground stocks of silver are the stockpiles held in the COMEX vaults (about 160 million ounces) and the silver ETFS (about 500 million ounces). Are we to infer excess silver demand will be met from these sources?

Silver held in Comex eligible warehouses as of February 11, 2016, was 157.59 million ounces.

Silver Institute Conclusion on Price

The price of silver has fallen the past several years despite demand outpacing demand. according to the Silver Institute. In the 2015 Interim Silver Market Review, the Silver Institute commented on the deficits and the price of silver: “While such deficits do not necessarily influence prices in the near term, multiple years of annual deficits can begin to apply upward pressure to prices in subsequent periods.”.In 2016 Silver Market Trends the Silver Institute wrote: “The silver price is expected to find solid ground this year. As of January 26th, silver prices are up 3.7 percent from the end of last year. This price appreciation is on the back of increased safe haven demand amid volatile and weakening equity markets across the globe.”

It seems inconceivable in any supply demand analysis for there to be a significant and persistent shortfall in supply of an underlying commodity while the price falls consistently. There is either a miscalculation of the price of silver at the price setting mechanisms at COMEX and the LBMA Silver Price and/or a miscalcuation of the physical silver supply and demand dynamic.

No comments:

Post a Comment