Despite the post-Brexit market rally, fund managers have gotten even more wary of taking risks.

The S&P 500 has jumped about 8.5% since the lows hit in the days after Britain’s move to leave the European Union, but that hasn’t assuaged professional investors. Cash levels are now at 5.8% of portfolios, up a notch from June and at the highest levels since November 2001, according to the latest Bank of America Merrill Lynch Fund Manager Survey.

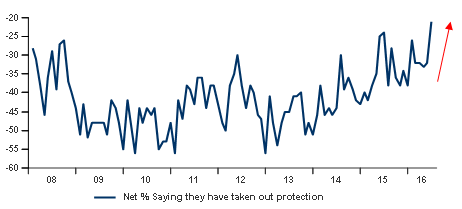

In addition to putting money under the mattress, investors also are looking for protection, with equity hedging at its highest level in the survey’s history.

Source: BofA Merrill Lynch Global Fund Manager Survey

Indeed, fear is running high as

investors believe that global financial conditions are tightening,

despite nearly $12 trillion of negative-yielding debt around the world

and the U.S. central bank on hold perhaps until 2017.

In fact, fear is running so high that BofAML experts think that it’s helping fuel the recent market rally.“Record numbers of investors saying fiscal policy is too restrictive and the first underweighting of equities in four years suggest that fiscal easing could be a tactical catalyst for risk assets going forward,” Michael Hartnett, chief investment strategist, said in a statement.

Positioning changed, with a rotation from euro zone, banks and insurance companies shifting to the U.S., industrials, energy, technology and materials stocks.

Fund managers believe that so-called helicopter money will become a reality, with 39% now anticipating the move compared to 27% in June.

Read the full story at CNBC here…

No comments:

Post a Comment